Faster company processes, with results in a short time.

OPPORTUNITIES WITH ORACLE EBS.

Whether your company is large or small, chances are you have faced the decision to outsource at some point; And in simple terms, a business process outsourcing (BPO) acts as a third-party subcontractor that provides an end-to-end managed service for certain business processes. For example accounts payable.

Data capture plays an important role in every business. This is one of the first processes to be outsourced to accounting BPOs with the goal of reducing costs as much as possible while supporting a high volume of invoices.

Despite the fact that data extraction is relatively easy to automate, many of these BPOs still have humans sitting at desks to manually enter invoice data into spreadsheets, accounting systems, and other business software.

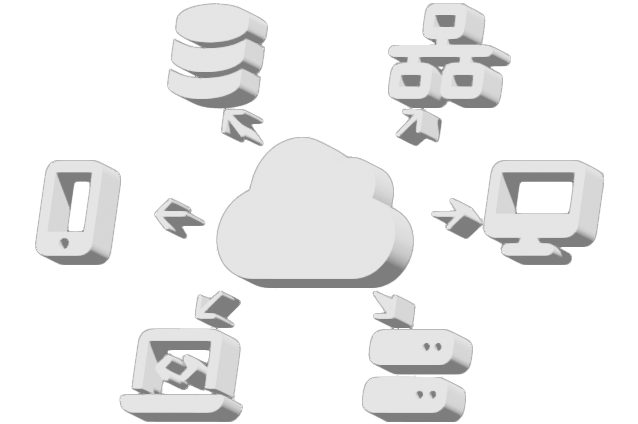

Streamlining your accounting operation with an automated cloud-based invoice data capture platform can produce the following:

• Cost savings

• Value generation

• Better exchange of information

• More actionable perspectives

Just as you ask potential BPOs about their security measures to ensure they will keep your data confidential, you should also analyze your technical infrastructure to ensure it can handle your document volumes and SLAs. Otherwise, you risk a failed implementation months later. When your accounting BPO uses automated data capture, they can be a valuable ally in your efforts to ensure continued growth for your company.

Sometimes your best option is to allow a small error rate in the SLA while adding additional automated checks on your end to compensate for any inconsistencies.

A growing number of accounting BPOs are realizing that it makes no sense to outsource manual data processing, regardless of geographic location.

Instead, they are choosing cloud-based automated solutions that can relieve their typists' minds and fingers from constantly moving information from one place to another.

When it comes to invoices received in EDI format, things are never as simple as they seem. Exception handling is often necessary. We make it easy, the multichannel solution allows you to process invoices regardless of their format or channel (postal mail, email or EDI).

Convert EDI invoices into a human-readable format, so they can be treated in the same way as other standard invoices from your suppliers.

Get a complete view of your suppliers and your supply cycle, with a dynamic workflow that facilitates the registration of new suppliers and decision making.

Reduce manual data entry, eliminate redundant operations, and avoid costly human errors with the help of automated data capture and validation.

Allows accounts payable users to unify their workflow even across multiple ERP instances, allowing: anytime, anywhere access; a simpler training process and better user adoption of the tool; support for setting up shared services centers; possibility of approving invoices even for non-ERP users

Optimize invoice capture with minimal investment and disruption to your established accounts payable practices. ABBYY feeds data into your existing ERP system, workflow or business intelligence tools, making them more informative and useful.